美国经济可能衰退

2007-11-20

[2007.11.15]America's vulnerable economy

Recession in America

America's vulnerable economy

脆弱的美国经济

Nov 15th 2007

From The Economist print edition

Recession in America looks increasingly likely. Can booming emerging markets save the world economy?

美国衰退可能性增大。繁荣的新兴经济市场能否挽救世界经济?

IN 1929, days after the stockmarket crash, the Harvard Economic Society reassured its subscribers: “A severe depression is outside the range of probability”. In a survey in March 2001, 95% of American economists said there would not be a recession, even though one had already started. Today, most economists do not forecast a recession in America, but the profession's pitiful forecasting record offers little comfort. Our latest assessment (see article) suggests that the United States may well be heading for recession.

1929年的美国股市崩溃之后,哈佛经济学社给它的赞助者打了一剂定心剂:“发生经济大萧条的可能性微乎其微。”2001年3月的一份调查显示,95%的美国经济学家认为经济不会衰退,即便衰退已经开始。现在,大多数的经济学家预测美国不存在经济衰退。但因为他们乏善可陈的预测成绩,人们并没有感到安心。我们最新的评估显示,美国经济正走向衰退。

Granted, GDP grew by a robust 3.9%, at an annual rate, in the third quarter. Granted also, revisions may well push this figure up. But that was the past. More timely signs suggest that the economy could stall in this quarter. By early next year, output and jobs could be shrinking. The main cause is the imploding housing market. Experts said that house prices could never fall nationwide. But fall they have, by 5% in the past 12 months. Residential investment has collapsed, but a glut of unsold homes means that prices have much further to drop. Americans' spending is likely to be dented much more by a fall in house prices than it was in 2001 by the stockmarket's collapse. With house prices lower and credit conditions tighter as a result of the subprime crisis, households can no longer borrow against capital gains to support their spending.

诚然,美国第三季度的经济增长率高达3.9%,而且,修正后的增长率可能更高。但那已经过去了。很多即期数据显示,美国经济可能会在这个季度熄火。急转直下的房地产市场,可能会导致下年年初产出和工作机会的收缩。虽然专家们说过不会出现全国性范围的房价下跌,但在过去12个月房价已经下跌了5%。房产投资已经崩溃了,大批买不出去的商品房意味着住房价格会继续下跌。由于住房价格的下跌,美国国内支出与股市跳水的2001年相比要少得多。次贷危机让房产价格进一步下降,让信贷环境更加恶劣,那些房东再也不能借到用于支出的资金。

Dearer oil is set to squeeze households further (this week's drop in crude prices notwithstanding). Consumer confidence has already fallen sharply. It cannot be long before consumer spending stumbles, which in turn would hurt companies' profits and investment. The weak dollar will boost exports, but at only 12% of GDP, exports are too small to make up for a weakening of consumer spending, which accounts for 70%.

昂贵的石油让居民的手头更紧,虽然这个星期原油价格有一定下降。消费者信心已经急剧下,消费的大幅下降为时不远了。这种下降反过来会损害企业的利润和投资。弱势美元能增加出口,但仅占GDP12%的出口并不足以抵消占GDP70%的消费支出的弱化。

I want to break free

自由贸易的迷思

Will an American recession drag the rest of the world down with it? The economies of Europe and Japan rebounded strongly in the third quarter, but look likely to slow down. Although both should be able to keep chugging along, neither is likely to set any great pace. Strengthening currencies will hurt exporters in both places. Europe's own housing hotspots are cooling, and some of its banks have been sideswiped by America's subprime ills.

美国经济衰退是否会拖累整个世界?虽然第三季度,欧洲和日本的经济强劲反弹,但看起来很可能趋缓。虽然两者都能稳步前进,但却不能保持一致步骤。欧元和日元汇率的上升会损害他们的出口。欧洲的房产热点正在冷却,而且一些银行在美国次贷危机中遭受波及。

The best hope that global growth can stay strong lies instead with emerging economies. A decade ago, the thought that so much depended on these crisis-prone places would have been terrifying. Yet thanks largely to economic reforms, their annual growth rate has surged to around 7%. This year they will contribute half of the globe's GDP growth, measured at market exchange rates, over three times as much as America. In the past, emerging economies have often needed bailing out by the rich world. This time they could be the rescuers.

现在只能期望,新兴经济体能让世界经济保持强劲增长。要是在十年前,这种认为世界经济必须依赖这些容易爆发危机的地区的想法,能让人不寒而栗。得益于经济的重组,新兴经济的经济增长率达到7%。以市场汇率计算,他们将贡献今年世界经济的一半增长,是美国的3倍之多。在过年,新兴经济经常需要世界的救济。这次,他们充当了一次救世主。

Of course, a recession in America would reduce emerging economies' exports, but they are less vulnerable than they used to be. America's importance as an engine of global growth has been exaggerated. Since 2000 its share of world imports has dropped from 19% to 14%. Its vast current-account deficit has started to shrink, meaning that America is no longer pulling along the rest of the world. Yet growth in emerging economies has quickened, partly thanks to demand at home. In the first half of this year the increase in consumer spending (in actual dollar terms) in China and India added more to global GDP growth than that in America.

当然,新兴经济的出口会因美国的衰退而减少,但他们已经没有以前那么脆弱了。美国进口做为世界经济增长发动机的作用被过分夸大。到2000年,美国进口在世界进口所占的份额从19%下降到14%。经常性帐户赤字余额开始缩减,意味美国不再是世界经济的拉动者。新兴经济的加速增长,一部分要归功于国内需求。中国和印度今年前半年消费者支出的增长(以美元计)对全球GDP增长的贡献更甚于美国。

Most emerging economies are in healthier shape than ever (see article). They are no longer financially dependent on the rest of the world, but have large foreign-exchange reserves—no less than three-quarters of the global total. Though there are some notable exceptions, most of them have small budget deficits (another change from the past), so they can boost spending to offset weaker exports if need be.

大部分新兴经济体的增长要比以前更健康。他们不再依靠外部资金,相反拥有大量的外汇储备——不少于世界外汇储备总量的四分之三。虽然存在一些例外,更多的新兴经济体只有很少的预算赤字(另一个变化),因此他们能以增加支出的方式去抵消出口减少带来的不利影响。

This does not mean emerging economies will grow fast enough to make up for the whole of a fall in America's output. Most of them will slow a bit next year: for instance, China's growth rate may dip to “only” 10%. So global growth will ease—which, after five years at an average of almost 5%, close to its fastest pace ever, it needs to do. But thanks to the vigour of the new titans, it will stay above its 30-year average of 3.5%.

但这并不意味,新兴经济的增长能够快到消除美国产出下降带来的后果。大部分新兴经济下年的增长将会减缓:比如,中国的增长率可能下降到“只有”10%。所以,在经历了5年年均5%——接近历史最高水平——的增长之后,全球经济增长将会降温,这也是必须的。但得益于新经济巨人的活力,世界经济的增长率仍会高于3.5%这个30年年均增长率。

A tale of two prices

价格背后的故事

The rising importance of the world's new giants will not only boost growth. It will also shift relative prices, notably those of oil and the dollar. And the consequences of this will be less comfortable for developed countries, especially America.

日益重要的世界大事并不仅仅是如何促进经济增长,还有如何以相对价格标示石油和美元。对发达国家,尤其是美国来说,这件事更加紧迫。

The oil price has risen mainly because of strong demand in emerging economies, which have accounted for as much as four-fifths of the total increase in oil consumption in the past five years. In past American recessions the oil price usually fell. This time it is likely to hold up. That will not only hurt the finances of Western consumers, but may also make the jobs of their central bankers harder, by combining inflationary pressure with economic slowdown.

石油价格的上涨,主要是因为新兴经济体的强劲需求。过去5年中,石油消费增长中的五分之四来自新兴经济体。以前美国的衰退会造成油价的应声下跌。这次油价却居高不下,不但损害了西方消费者的财政,而且和通胀一道,让央行的工作更为棘手。

The enfeebled dollar—lately in sight of $1.50 to the euro—would be weaker still without enormous purchases by central banks in emerging economies. This support is now waning. China and others are putting a smaller share of increases in reserves into the American currency. And Asian and Middle Eastern countries with currencies linked to the dollar are facing rising inflation, but falling American interest rates make it harder to tighten their own monetary policy. They may have to let their currencies rise against the sickly greenback, meaning they will need to buy fewer dollars. More important, as international investors wake up to the relative weakening of America's economic power, they will surely question why they hold the bulk of their wealth in dollars. The dollar's decline already amounts to the biggest default in history, having wiped far more off the value of foreigners' assets than any emerging market has ever done.

如果新兴经济体的央行不大量买进美元的话,本来就虚弱的美元——1欧元兑1.5美元——可能会更加弱势。他们的支持是苍白乏力的。中国和其他国家的央行投入美元的外汇储备越来越少。那些货币和美元挂购的亚洲和中东国家正面临不断上升的通货膨胀,持续下跌的美元利率又让他们更难以收紧货币政策。因此,他们不得不让他们的货币保持对疲弱美元的升值。这就意味着他们只需要购买比以前少的美元。更要命的是,国际投资者意识到美国经济的相对虚弱,他们当然会问为什么他们要持有大量的美元资产。美元下跌已经接近历史低点,由此被抹去的外国资产比新兴经济体创造的资产还要多。

The vigour of emerging economies is good news for the world economy: for its growth, it has much less need of a strong America. The bad news for America is that this, in turn, may mean that the world also has less need of the dollar.

新兴经济体的活力对世界经济而言是个好消息:它的增长,可以更少地依靠强劲的美国经济。对美国而言,这种改变却是个坏消息,因为这意味世界对美元的需求也减少了。 |

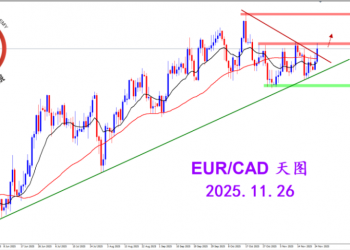

2025.12.16 图文交易计划:布油开放下行 关753 人气#黄金外汇论坛

2025.12.16 图文交易计划:布油开放下行 关753 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关2804 人气#黄金外汇论坛

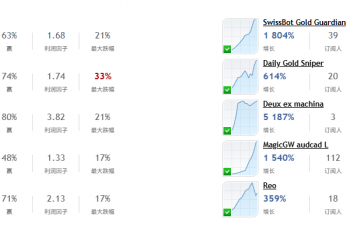

2025.11.26 图文交易计划:欧加试探拉升 关2804 人气#黄金外汇论坛 MQL5全球十大量化排行榜2899 人气#黄金外汇论坛

MQL5全球十大量化排行榜2899 人气#黄金外汇论坛 【认知】5697 人气#黄金外汇论坛

【认知】5697 人气#黄金外汇论坛