- EUR/USD recovery sold off to a new low for the downmove from the 1.1925 top, going to a slow as 1.1542 in late New York, despite lower equity markets. The sell-off stemmed from expectations of a 25 basis point cut, rather than the 50 bp that was expected earlier. A fall to new low is always dangerous, so let us see if the recent sell-off has eliminated the chances of a recovery to 1.1780 - 1.1800. We need to see more data later today, as the price action in Asian trading was inconclusive. Action in Europe and New York will go along way in determining whether or not we get another shot at the 1.1780 swing point later in the week. It is a tough call at these levels either way: (1) the currency is deeply oversold in the very short-term, (2) the U.S. and European equity markets are not looking too well technically, which may temper the EUR bearishness, (3) the ECB may hold rates at current level for a while, and (4) failure of established support levels should not be taken lightly however, and if a test of resistance at 1.1640 fails to go through later today, then the sell-off might continue. For now, we need more input and since previous long positions have been taken out at profit-stop levels, then we would stand aside to see how things shape up ahead of the Fed meeting on June 25, as we simply do not if the test will fail or not. However, we still beleive that the EUR/USD uptrend is not over yet, and we are still looking for a subsequent move to 1.21 - 1.22 then to 1.25 further out.

- GBP/USD sell-off stabilized at 1.6586, refuting the thought that the downside correction is over. As in the EUR/USD, the data set from Asia has not given enough basis for action either way. The initial resistance at 1.6700 acts as gateway for further upside progress - a succesful attack at the level may lay the groundwork for a new upcylce. Conversely, failure of a 1.6700 test suggest futher downside scope. At this point, we can't say which view one will prevail. Nonetheless, we are still convinced that the GBP/USD bull phase is not over yet. But if there is still some scope to the downside, then there is no urgency to go long at this time, and we would rather wait for better and lower levels to make another foray into the long side of the cuurency, looking still for 1.7000 then 1.7370 further out. USD/JPY recovery off the 118.03 low has been uneventful so far -- there is no change in the negative short-term outlook. The unit should continue to fall, the next support expected at 117.75. We still expect the unit to turn even lower later in the week. The next break of support, now at 117.20, should bring in 116.20 once again further out. We still believe that a fall to 115.00 is still in the pipeline in the slightlly longer-term.

- USD/CAD rose sharply during Friday's New York session, and has been to as high as 1.3642 on an Asian follow-through earlier today. There could be further upside scope, like 1.3660 from here. But the rally seems overdone, and would be meeting chart resistance at those slightly higher levels. The risk here is further upmove to 1.3900 area, so there is no hurry to set-up short positions just yet. We will wait for more data so we can fine-tune tactics here. If there is a good chance of further appreciation in the unit, then we will wait for higher levels like 1.3900 to set up shortpositions. We still expect further declines to 1.3000 further out. USD/CHF retested 1.3370 high, and its hard to say whether or not we will get another upside follow-through to 1.3380 area, as there is as yet insufficient data. We want to see further declines to test minor 1.3240 swing point. A break to the downside obviously eases some of the accompanying momentum. But wherever the short term terminus will eventually occur, the longer-term negative view should eventually reassert. Longer-term, the 1.25 - 1.24 targets should come into focus again.

- AUD/USD has been to .6656 again -- and once more the recovery since then looks promising. The minor swing level at 1.6700 may attract the unit again as the consolidation phase continues. A move to the .6740 top should come soon. A break of the .6740 top is still the ultimate confirmation that the uptrend has resumed. The rally should accelerate after a break, and .6850 remains the immediate objective in the very near-term. Further out, we are now factoring-in .7000 as target. NZD/USD currency has gone down to just under 5820 in keeping with the consolidation phase the unit is currently undergoing. The uptrend is still set to resume further. The next upside target is still the top at 5890. Further out, the rally may bring the unit to .6050 - .6100 targets again. EUR/JPY has taken out 137.25 support, but the cross has been looking for support since then. It is still too early to say whether or not support at 136.63 will hold, and we would like to see how the currencies will fare in both Europe and New York session today. But we expect the main bullish scenario to keep nonetheless, and we will maintain 140.20 as immediate atrget, and 145.00 the destination further out. |

2026.2.13 图文交易计划:美指持续震荡 等1469 人气#黄金外汇论坛

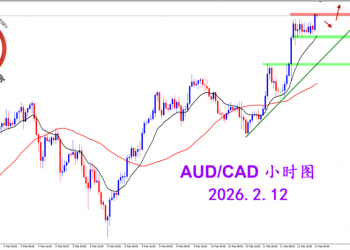

2026.2.13 图文交易计划:美指持续震荡 等1469 人气#黄金外汇论坛 2026.2.12 图文交易计划:多头持续挺进 澳1394 人气#黄金外汇论坛

2026.2.12 图文交易计划:多头持续挺进 澳1394 人气#黄金外汇论坛 2026.2.11 图文交易计划:磅加坚决阴线 适1644 人气#黄金外汇论坛

2026.2.11 图文交易计划:磅加坚决阴线 适1644 人气#黄金外汇论坛 2026.2.10 图文交易计划:美瑞大幅下跌 等1548 人气#黄金外汇论坛

2026.2.10 图文交易计划:美瑞大幅下跌 等1548 人气#黄金外汇论坛