欧元/美元将再次测试1.2460顶部——这一次可能突破;美汇加元应下跌到1.3060底部以下。

Saxo 银行现推出罗伯特的外汇分析华语版。鉴于时间关系,总体介绍部分暂保留英文原文。我们目前向客户提供全部主要外汇币种走势的译文,向会员提供3对主要币种的分析。客户请点击All,可获得中文信息,会员请点击前三对币种,查看中文信息。

外汇分析华语版Saxo Bank 版权所有,深浪投资网编译,不当之处请参阅英文原文。

声明: 分析内容仅供参考,据此入市,风险自负。Saxo Bank 不对因译文错误,更新延迟及因此而产生的投资行为承担任何责任。

DEVELOPMENTS TO WATCH TODAY: July 20 - Europe

- U.K. house price inflation slid in June to the slowest pace in 10 months after the Bank of England boosted interest rates in consecutive months, the Royal Institution of Chartered Surveyors said. The net balance of surveyors reporting a rise in house prices from a year ago, minus those identifying a fall, slipped to 17 percent from 43 percent in May, the second successive decline. Central bank Governor Mervyn King, who last month alerted potential homebuyers to the risks of declines in house prices, has presided over four increases in the benchmark lending rate since November. Today's survey supports evidence from mortgage lenders, including the U.K.'s largest, HBOS Plc, that higher borrowing costs are slowing price growth.

FX Market Summary -

The dollar traded near a four-month low versus the euro in Asia today on speculation Alan Greenspan will reiterate the Federal Reserve will lift interest rates at a ``measured'' pace. Greenspan testifies to a Senate committee on the U.S. economy and monetary policy at 2:30 p.m. in Washington. The Fed on June 30 raised its key interest rate for the first time in four years to 1.25 percent from a 45-year low. The European Central Bank's rate is 2 percent, making euro-denominated debt more appealing. Against the euro, the dollar was at $1.2429 at 11 a.m. in Tokyo from $1.2444 late yesterday in New York. The U.S. currency yesterday dropped as low as $1.2461, its weakest since March 2. It was at 108.42 yen from 108.25.

Demand for the yen waned today as Japanese shares declined, discouraging investors from seeking the country's assets and the currency to buy them. Japan's Nikkei 225 Stock Average dropped as much as 1.8 percent, extending its decline this month to 5.2 percent. Overseas investment in Japanese stocks in the week to July 9 dropped 92 percent from the previous week to 15.2 billion yen ($140 million).

The US dollar gained a respite on Monday, strengthening modestly against sterling and the euro after plummeting to four-month lows against these currencies on Friday amid yet more soft US economic data and a growing realisation that overseas investors are falling out of love with US assets. On Monday a dose of profit-taking allowed the dollar to firm 0.2 per cent against the euro to $1.2426, 0.1 per cent versus sterling to $1.8730 and 0.3 per cent to SFr1.2276 against the Swiss franc. Some also attributed the dollar's modest fightback to a wariness among speculators to further extend short-dollar positions, which are already near historic extremes. Non-commercial (ie speculative) dollar shorts against these three European currencies have risen to $11bn, as traders bet on further dollar weakness to come.

The main exception to this trend is the yen, on which speculators remain neutral, according to the most recent data. This potentially gives the Japanese currency greater scope to gain ground against the dollar, and that is precisely what happened on Monday, as the yen rose 0.4 per cent to Y108.26 against the dollar, firming 0.6 per cent to Y134.53 versus the euro and 0.5 per cent to Y202.68 against sterling in the process.

Forex Technicals:

- EUR/USD - the currency's unexpectedly large correction has probably ended at 1.2400, and is set to have another go at 1.2460 top. Perhaps Tuesday's U.S. Senate Banking Committee testimony from Greenspan , who might reiterate the measured pace outlook for future rate hikes, would be negative for the dollar and may provide the wherewithal for euro to make a break through. Friendly fundamentals and positive technicals should continue to buoy the currency going forward, and should push through to and beyond 1.2500 soon. Firmer resistance await near 1.2700. Momentum is getting set for follow-through to 1.2900 further out.

- GBP/USD - the currency rose to 1.8775 in Asia, but extended the correction in the wake of U.K. house price inflation sliding in June to the slowest pace in 10 months. The currency has gone to as low as 1.8637. But the currency should recover soon -- upwards momentum should resume from here (1.8663). Positive technicals and expectation of further UK rate hikes will likely underpin the currency forward even further in the days to come. The rally through 1.8750 has reconfirmed the 1.9100 main target within the next couple of weeks.

- USD/JPY - the currency pair recovered to 108.65 so far and may extend the rise to 108.80. But the reprieve to the U.S. dollar is temporary and will likely be brief -- the downtrend should resume soon, with the 107.60 baseline as next target.

- USD/CHF - the currency extended the rebound and has been to 1.2315. The recovery starts to fail though, and the downtrend may resume soon. The currency pair should follow through lower once more towards the 1.2210 minor base. We still expect to see further declines to 1.2150 major support level and then through 1.2000 much further out.

- USD/CAD -- the currency pair continues to consolidate while awaiting further development in the data front. Nonetheless, the downtrend should continue, with 1.3000 -1.2950 as next target. But much further out, focus now at 1.2700.

- AUD/USD - the currency has corrected back to .7320 since the .7347 top -- support should be forthcoming at just about these levels. No change in view -- the rally should continue, accelerate further and should make it to the minor resistance at .7370 area. Further out, the uptrend should focus at .7500 objectives.

- NZD/USD - the currency fell sharply but recovered at .6535 and may have initiated a new uptrend, which should challenge the .6620 top later in the week. The currency should then continue to trade higher towards .6750, then to the .7050 new focal point further out.

- EUR/JPY - the cross found support at 134.20 and has recovered strongly since then. It may go further north, and may rise to 1.3650 before significant resistance appears. The longer-term scenario takes on a large sideways consolidation requiring a sell-off from 138.00 - 139.00 potential resistance.

- EUR/CHF - new support was found at 1.5260 and should resume the uptrend and break through the 1.5300 barrier later in the day. The rally should propel the cross through 1.5300 to 1.5350 further out. Any rally above 1.5430 suggests that the long bear market is over.

- EUR/GBP - the cross did retest the .6630 bottom and has been higher since then. The cross should continue to recover -- the uptrend soon accelrates, with .6700 as immediate focus, and has .6820 as prime upside focus.

===========================================

DEVELOPMENTS TO WATCH TODAY: July 19 - New York

- German Chancellor Gerhard Schroeder's council of economic advisers raised their growth forecast for Europe's largest economy as the fastest global expansion in four years drives export demand. The German economy will expand 1.8 percent this year compared with the five-member council's previous projection of 1.6 percent, said Jens Ulbrich, a spokesman for the Wiesbaden-based council. The Bundesbank said today growth probably accelerated in the second quarter compared with the first three months of the year. Germany's economy expanded at the fastest pace in three years in the first quarter as a U.S. and Asian-led global recovery boosted foreign sales at companies including Siemens AG. Four of Germany's six state-funded leading economic institutes have also raised their 2004 growth forecasts in the past month.

- Italy's Reform Minister Umberto Bossi quit the government of Prime Minister Silvio Berlusconi to join the European Parliament, extending a five week-long crisis that threatens the stability of Italy's longest-serving government since World War II. Bossi, 62, has been out of the public view since a heart attack in March, raising concerns about the party's leadership. Roberto Calderoli, one of his closest collaborators, is poised to replace him as a cabinet minister with the task of pushing a bill handing over powers to local authorities, Ansa reported.

FX Market Summary -

The dollar was mixed against the majors today. The euro fell to $1.2400 from $1.2440 Friday, while the yen strengthened to 108.20 against the dollar from 108.71 on Friday.

There is no data on the U.S. calendar today, but markets are anticipating Chairman Greenspan’s testimony to the U.S. Senate tomorrow. The tone of the testimony is likely to outline continued strength in the economic recovery, but given the tepid CPI report on Friday, the Chairman will no doubt reinforce that the Fed will continue to hike rates at a “measured” pace. Key U.S. data this week include the June print on housing starts and initial jobless claims.

The pace of euro-zone industrial output rose 0.7% (m/m) and 3.9% (y/y) led higher by capital goods. This fourth consecutive monthly gain is a good sign for the robustness of the currency area’s industrial resurgence. But results from France, Germany, Italy and Spain were uninspiring. The May data on Italian industrial orders confirmed the weakness. It fell 1.2% (m/m) which more than reverses April’s 0.8% gain and suggests that industrial activity in June will remain relatively weak. The euro’s weakness today came not only on the back of modestly improved dollar sentiment but the news that another minister in PM Berlusconi’s cabinet resigned, suggesting weakening support for the government.

The yen rose against the dollar, in anticipation of a firm trade report due on Thursday. The MoF data released last week noted that foreign investors were net purchasers of Japanese securities for the week of July 9. The correlation between the Nikkei and the yen remains strong, which should continue to buoy the yen in the near term. Many investors have withdrawn money from emerging markets and bought stocks in Japan, China and India, according to research published Saturday by EmergingPortfolio.com. Japan's currency strengthened to 108.43 per dollar at 7:46 a.m. in New York from 108.71 Friday. Japanese markets were closed today for a national holiday.

The Canadian portfolio flows data continue to show foreign inflows into Canadian markets. Foreigners bought C$1.32 billion worth of Canadian securities­mostly in bonds. This comes on the back of a record foreign inflow worth C$20.4 billion of Canadian assets in April. The better tone to the Canadian market will not be ignored by the Bank of Canada at tomorrow’s meeting, but the central bank is unlikely to raise rates at this meeting. As such, we expect building interest rate expectations to buoy the C$ in the coming weeks.

Australia's dollar rose to an 11-week high on expectations the nation's bond yields will hold above those in the U.S. after a report showed slower-than-expected inflation in the world's biggest economy. The local dollar has rallied 6.5 percent against its U.S. counterpart in the past month, the biggest gain of 15 currencies in Asia and the Pacific. A report Friday showed U.S. consumer prices excluding food and energy rose at the year's slowest pace in June, feeding expectations the Federal Reserve will keep raising interest rates gradually. Australia's dollar climbed to 73.38 U.S. cents at 12:11 p.m. in Sydney from 73.23 cents in late trading in New York Friday. The currency rose earlier to 73.47 cents, the highest since April 28.

The Reserve Bank of Australia's benchmark interest rate is 5.25 percent and New Zealand's is 5.75 percent, compared with 1.25 percent at the Fed. The Australian dollar reached an 11-week high of 73.47 U.S. cents and has risen 4.9 percent since the Fed's June 30 statement. New Zealand's dollar traded near a three- month high at 66 U.S. cents on speculation the central bank will raise its key rate as soon as this month.

Forex Technicals:

- EUR/USD - the currency consolidates and unexpectedly retraces half of Friday's outsized gains. The correction has been larger than expected, but the short-term technical outlook remains positive still -- unless the currency falls below 1.2380. The sell-off was a fallout from Italian FinMin Unberto Bossi's quitting the government of Prime Minister Silvio Berlusconi. The previous finance minister, Giulio Tremonti, quit as finance minister on July 3. The currency should regain composure later in the day and should have another go at 1.2460 top. And perhaps Tuesday's U.S. Senate Banking Committee testimony from Greenspan , who might reiterate the measured pace outlook for future rate hikes, would be negative for the dollar and may provide the wherewithal for euro to make a break through. Friendly fundamentals and positive technicals should continue to buoy the currency going forward, and should push through to and beyond 1.2500 soon. Firmer resistance await near 1.2700. Momentum is getting set for follow-through to 1.2900 further out.

- GBP/USD - the currency rose to 1.8775 in Asia, corrected part of Friday's gains, and may have ended the retracement at 1.8688. The upwards momentum should resume from there -- positive technicals and expectation of further UK rate hikes likely underpinning the currency forward even further in the days to come. The rally through 1.8750 has reconfirmed the 1.9100 main target within the next couple of weeks.

- USD/JPY - the dollar continues to weaken across the board -- the currency pair fell in Asia today to as low as 108.15. Support may not appear again unitl 107.60 baseline. We may yet see further upmove to 111.00 thereafter.

- USD/CHF - the currency has been sharply lower further in the wake of benign CPI data on Friday, but continues to consolidate which mnay end at 1,2320 area. The currency pair should resume the downtrend, and follows through lower once more towards the 1.2210 minor base. We still expect to see further declines to 1.2150 major support level and then through 1.2000 much further out.

- USD/CAD -- the currency pair fell sharply in the back of friendly CPI data on Friday and basically consolidates while awaiting further development in the data front. Nonetheless, the downtrend should continue, with 1.3000 -1.2950 as next target. But much further out, focus now at 1.2700.

- AUD/USD - the currency has been higher still since Friday's sharp rally, reached .7347 and corrected back to .7320 since then -- support should be forthcoming at just about these levels. The rally should continue, accelerate further and should make it to the minor resistance at .7370 area. Further out, the uptrend should focus at .7500 objectives.

- NZD/USD - the currency recovered on Friday, consolidates along a narrow band, and is set to challenge the .6620 top later in the trading day. The currency should then continue to trade higher towards .6750, then to the .7050 new focal point further out.

- EUR/JPY - the cross continues to pull back --- support did not appear at 134.30 as we expected, suggesting further pullback to come. It may fall further towards 133.80 - 133.60 area later in the week. Nonetheless, it may then go further north, and may rise to 1.3650 before significant resistance appears. The longer-term scenario takes on a large sideways consolidation requiring a sell-off from 138.00 - 139.00 potential resistance.

- EUR/CHF - no change in the view -- support was found at 1.5240 area and should resume the uptrend . The next rally should propel the cross through 1.5300 to 1.5350 further out. Any rally above 1.5430 suggests that the long bear market is over.

- EUR/GBP - the cross did retest the .6630 bottom and may extend the weakness to .6620. The cross should recover later -- the uptrend resumes soon, with .6700 as immediate focus, and has .6820 as prime upside focus. |

2026.2.13 图文交易计划:美指持续震荡 等998 人气#黄金外汇论坛

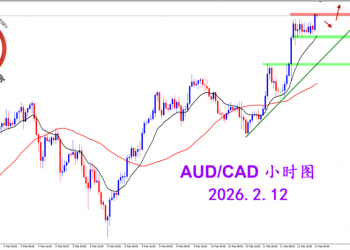

2026.2.13 图文交易计划:美指持续震荡 等998 人气#黄金外汇论坛 2026.2.12 图文交易计划:多头持续挺进 澳1070 人气#黄金外汇论坛

2026.2.12 图文交易计划:多头持续挺进 澳1070 人气#黄金外汇论坛 2026.2.11 图文交易计划:磅加坚决阴线 适1178 人气#黄金外汇论坛

2026.2.11 图文交易计划:磅加坚决阴线 适1178 人气#黄金外汇论坛 2026.2.10 图文交易计划:美瑞大幅下跌 等1118 人气#黄金外汇论坛

2026.2.10 图文交易计划:美瑞大幅下跌 等1118 人气#黄金外汇论坛