BoE MPC raises key repo rate by 0.25 points to 4.50 pct UPDATE

2004-06-10 19:10

(Adds comments from MPC)

LONDON (AFX) - The Bank of England raised its key repo rate another 0.25

points to 4.50 pct, following the latest meeting of the rate-setting Monetary

Policy Committee.

The decision was widely anticipated, with the raft of strong data this

week cementing expectations of the first back-to-back increase since early

2000.

The MPC said in its accompanying statement that economic data and surveys

continue to suggest that the UK economy is growing at, or above, trend, while

cost pressures are mounting.

"Household spending, public consumption and investment have all grown

strongly and the housing market remains buoyant," the MPC said.

In addition, the MPC said cost pressures are mounting, while the labour

market has tightened further.

"As indicated in the May Inflation Report, a small and diminishing margin

of spare capacity means that inflationary pressures are likely to continue

building," the MPC added.

The move today is the fourth 0.25 point increase by the Bank since

November as it seeks to rein in soaring consumer debt and a rampant housing

market, which is going from strength to strength despite previous hikes.

The latest survey from the Halifax bank found house prices accelerating

once again, with year-on-year inflation running above 20 pct.

More and more analysts are now warning of a potential housing market

crash.

In addition, strong manufacturing data for April is likely to have eased

concerns that higher borrowing costs are hitting the industrial sector hard.

Nevertheless, the decision to raise interest rates has taken place in an

environment of subdued inflation and lower-than-expected first-quarter

growth.

Further interest rate increases are expected this year, with some

forecasters predicting the benchmark repo rate will rise above 5.00 pct by

the end of 2004. |

2025.12.16 图文交易计划:布油开放下行 关566 人气#黄金外汇论坛

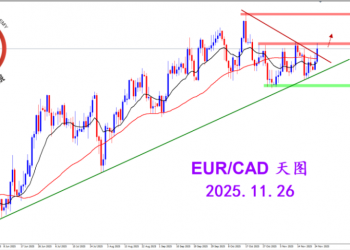

2025.12.16 图文交易计划:布油开放下行 关566 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关2794 人气#黄金外汇论坛

2025.11.26 图文交易计划:欧加试探拉升 关2794 人气#黄金外汇论坛 MQL5全球十大量化排行榜2878 人气#黄金外汇论坛

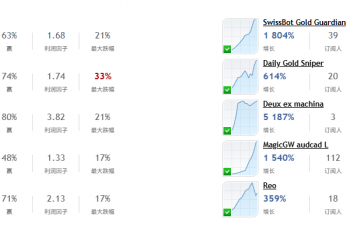

MQL5全球十大量化排行榜2878 人气#黄金外汇论坛 【认知】5680 人气#黄金外汇论坛

【认知】5680 人气#黄金外汇论坛