2004-06-08 22:32

WASHINGTON (AFX) -- Federal Reserve rate hikes are likely to be measured,

but the central bank is "prepared to do what is required" to fight inflation,

Fed board chairman Alan Greenspan said Tuesday. The FOMC statement at their

last meeting in May said that Fed rate hikes would be measured. "That

conclusion is based on our current judgment of how economic and financial

forces will evolve in the months and quarters ahead," Greenspan said in a

speech prepared for delivery via satellite to the International Monetary

Conference in London. "Should that judgment prove misplaced, however, the

FOMC is prepared to do what is required to fulfill our obligations to achieve

the maintenance of price stability so as to ensure maximum sustainable

economic growth," he said. Businesses are becoming more confident about the

economy and are now hiring "with some vigor," Greenspan said. At the same

time, many new hires are temporary workers, an indication that "business

caution remains a feature of the economic landscape," he said. Recent

financial indicators, including rapid money growth, "underscore that the FOMC

has provided ample liquidity to the financial system that will become

increasingly unnecessary over time," he said. Financial markets appear

prepared for higher interest rates, unlike 1994, Greenspan said, "though

history cautions that investors' anticipations of the cumulative magnitude of

policy actions and their timing under such circumstances are far from perfect.

" U.S. treasury prices turned lower after Greenspan's comments. The benchmark

10-year note declined 9/32 to 99 19/32, while its yield rose to 4.80 percent

from Monday's close of 4.77 percent. Greenspan said that there has been a

return of pricing power to businesses and the threat of deflation has ended.

Core consumer inflation, as measured by the personal consumption expenditures

index, has increased, Greenspan noted. The core PCE is up 1.4 percent over

the last year ended in May, compared with a 0.8 percent annual increase in

December of last year. But he said cost pressures have been "relatively

subdued." The rise of energy prices is a "worrisome element" that has been a

net drain on the economy and could boost inflation if the high price level

persists. "The recent modest declines in oil and natural gas prices may or

may not signal a trend but are nonetheless welcome," Greenspan said. |

2025.12.16 图文交易计划:布油开放下行 关384 人气#黄金外汇论坛

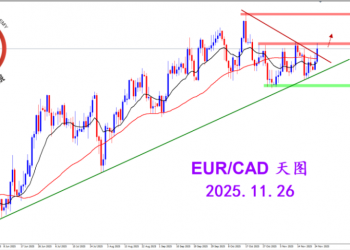

2025.12.16 图文交易计划:布油开放下行 关384 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关2789 人气#黄金外汇论坛

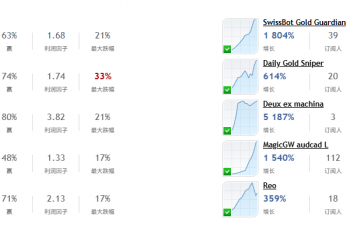

2025.11.26 图文交易计划:欧加试探拉升 关2789 人气#黄金外汇论坛 MQL5全球十大量化排行榜2868 人气#黄金外汇论坛

MQL5全球十大量化排行榜2868 人气#黄金外汇论坛 【认知】5669 人气#黄金外汇论坛

【认知】5669 人气#黄金外汇论坛