转一篇刚刚看到的博客

Short squeeze over? Crude oil fundamentals to overwhelm geopolitics ...

Quote

"Fools make researches and wise men exploit them." -H.G. Wells

Of Interest

China's manufacturing growth weakens as new orders drop (Businessweek)

China Lowers Interest Rates for Second Time in a Month to Bolster Economy (The Telegraph)

Hit at home, China's ghost fleet sails high seas (Reuters)

Commentary

Geopolitics were said to have played a role in crude oil's recent price spike. An Iranian official allegedly said Iran would move to block the Strait of Hormuz for those complying with US-led sanctions. The US military sent some ships (minesweepers) to the region should Iran act. And, of course, the situation in Syria has the potential to further intensify the conflict between Iran and the West. To some degree, it seems Saudi Arabia is alleviating some geopolitical premium in crude prices, as the world's top producer has not pared back its production despite a pullback in demand.

And that pullback in demand is very real -- China, the second largest energy consumer in the world, is seeing its gasoline refiners cut runs by 2% per day to trim back inventories. This comes on the back of a dip in Chinese crude oil demand in April (first in 3 years or so), followed by only a tepid rebound in May. And since we think the global economy is still downshifting, crude oil demand is likely to remain a weight on price.

Action

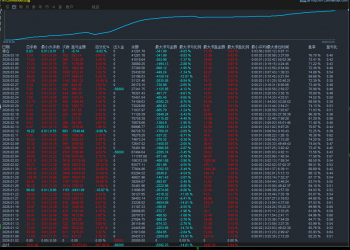

Traders have become well aware of these bearish fundamentals. So aware, the speculative short position in crude oil futures recently grew to the largest since September 2011. This suggests the magnitude of the move we saw in the past few trading sessions has more to do with short positions getting squeezed than it does with geopolitics. Is the squeeze over? Maye, maybe not. Either way, crude oil could very quickly drop to test the $70 per barrel level. One way to play for such a move is by using shares of the PowerShares DB Crude Oil Double Short ETN (symbol DTO). |  『TL888.vip』腾龙娱乐公司经理电话_科普知195 人气#黄金外汇论坛

『TL888.vip』腾龙娱乐公司经理电话_科普知195 人气#黄金外汇论坛 『TL888.VIP』腾龙娱乐公司游戏网址是多少_211 人气#黄金外汇论坛

『TL888.VIP』腾龙娱乐公司游戏网址是多少_211 人气#黄金外汇论坛 网址『TL888.vip』新盛娱乐公司官网是多少_151 人气#黄金外汇论坛

网址『TL888.vip』新盛娱乐公司官网是多少_151 人气#黄金外汇论坛 【K2科技EA】牛熊通吃:震荡不慌,单边不怕592 人气#黄金外汇论坛

【K2科技EA】牛熊通吃:震荡不慌,单边不怕592 人气#黄金外汇论坛