British Pound Falls Versus Dollar, Ending Two-Day Gain, on Growth Concerns

By Alison Scott

London, April 5 (Bloomberg) -- The British pound this week had its biggest two-day gain against the euro in three weeks on optimism the conflict in Iraq will end in weeks.

The pound strengthened to as much as 68.19 pence per euro on Thursday in London. That extended Wednesday's gain, making it a 1.3 percent advance over the two days, its biggest against the euro since March 12-13. It was at 68.69 pence per euro late yesterday from 68.57 the Friday before.

The dollar had its third week of gains in four against the yen and euro. Signs the war is progressing helps the pound against the euro because of the U.K.'s close military alliance with the U.S.

``The pound is being pulled along on the dollar's coattails,'' said Adam Cole, senior currency strategist at Credit Agricole SA in London. Cole expects the pound to be lower by June, though it will probably be at $1.60 by the end of the year.

U.S. armored columns gathered yesterday on the outskirts of Baghdad, after taking control of the main airport, 10 miles (16 kilometers) from the capital. About 2,500 soldiers of Iraq's Republican Guard have surrendered, Cable News Network reported.

The British currency has lost 2.9 percent versus the dollar this year. In the past five days, the Norwegian krone was the best- performing European currency against the dollar, followed by the Swedish krona. The euro shed 0.7 percent.

Dollar

The U.K. currency fell 0.83 percent in the week versus the dollar amid concern about slowing growth in the British economy. It traded at $1.5599 late yesterday in London from $1.5722 and $1.5730 a week earlier.

Figures published during the week showed service industries such as banks and airlines shrank last month for the first time in 15 months and retail sales fell at the fastest pace in almost 11 years.

In the first quarter, the U.K. economy may have expanded at half the rate of the previous three months, economists said.

Sputtering growth may prompt the Bank of England to reduce interest rates again soon. Twenty-one economists out of 30 surveyed by Bloomberg News expect the bank to lower borrowing costs by a quarter-point to 3.5 percent next month, while four predict a cut at next week's meeting.

The chance of an April reduction is now estimated at 40 percent, compared with 30 percent last week.

Last Updated: April 5, 2003 04:45 EST |

2025.12.16 图文交易计划:布油开放下行 关2627 人气#黄金外汇论坛

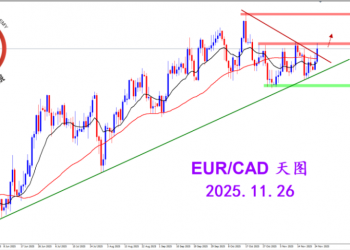

2025.12.16 图文交易计划:布油开放下行 关2627 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3178 人气#黄金外汇论坛

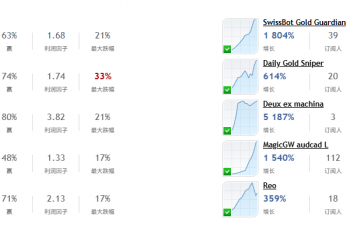

2025.11.26 图文交易计划:欧加试探拉升 关3178 人气#黄金外汇论坛 MQL5全球十大量化排行榜3246 人气#黄金外汇论坛

MQL5全球十大量化排行榜3246 人气#黄金外汇论坛 【认知】6039 人气#黄金外汇论坛

【认知】6039 人气#黄金外汇论坛