英文(路透社新闻,纽约1月16日早上10点)大意:

受强劲经济数据刺激,美元大幅上涨。11月外国购买美元资产876亿美元,大大高出10月的修正值278亿!(译者:早已有人偷偷在美元底位买入了大量美元!)。密西根大学消费信心指数从12月的92.6飙升到1月的103.2。

NEW YORK (Reuters) - The dollar rose steeply against most major currencies on Friday, boosted by robust economic data that seemed to confirm a more vigorous U.S. recovery.

Net foreign purchases of U.S. assets jumped to $87.6 billion in November, sharply higher than a revised $27.8 billion in October.

"Total (dollar) positive reaction to the flows data. It was almost instantaneous. The private accounts showed a big turnaround," said Grant Wilson, vice president at Mellon Bank in Pittsburgh.

"This more than covers the huge (current account) deficit that we run because this is such a huge number. This is very, very dollar positive," he said.

By midmorning New York trade, the euro was trading at $1.2432 (EUR=: Quote, Profile, Research) , off more than 1 percent, and close to 5 cents from Monday's record highs around $1.29. The euro fell more than 1 percent against the yen to 131.76 (EURJPY=: Quote, Profile, Research) , near the day's low.

But the dollar was 0.3 percent down at 106.01 yen (JPY=: Quote, Profile, Research) , having hit a low around 105.70 before being turned back by suspected Bank of Japan intervention.

Against the Swiss franc, the dollar rose over 1 percent to 1.2608 francs (CHF=: Quote, Profile, Research) . Sterling fell to $1.8056 (GBP=: Quote, Profile, Research) , off 0.8 percent on the day.

Even a lower than expected increase in U.S. industrial production did not dent the dollar's rally. Industrial production rose a 0.1 percent, while the percentage of firms' capacity in use was steady at 75.8 percent.

U.S. business inventories rose 0.3 percent in November after a 0.4 percent increase the previous month, indicating a pickup in economic activity.

A University of Michigan preliminary survey on consumer sentiment came in at 103.2 in January, compared with December's final reading of 92.6. The median forecast had called for 94.0. This was the highest reading since November 2002.

"That figure certainly helps the ECB's (European Central Bank) cause, and they wouldn't mind a rapid fall in the euro. They're sitting there and saying 'Keep going, keep going'," said Brian Taylor, head forex trader at Manufacturers and Traders Bank

This week's barrage of comments from euro zone officials expressing concern about the surging single European currency showed no signs of abating on Friday.

ECB chief economist Otmar Issing launched Friday's offensive, which added to downward pressure on the euro, saying the central bank was not indifferent to the euro's strength.

Issing's comments and those of other European officials this week fueled speculation that the ECB could cut rates at its next meeting in February to stem the euro's climb, analysts said.

"There's a sudden shift in attitude in the sense that there is greater acceptance that the dollar is going to have a correction partly because of what may or may not happen at the G7 meeting," said Mike Malpede, senior foreign exchange analyst at Refco Group Ltd in Chicago.

Central bankers and finance ministers of the world's seven major industrialized nations are due to meet in early February in Florida.

"My bias is nothing on the macro backdrop has changed for the dollar that much. This a question of how much we can run at the threat of verbal intervention or an ECB rate cut," he added. Previous 1| 2

[ Last edited by liuzhehui on 2004-1-17 at 01:12 AM ] |

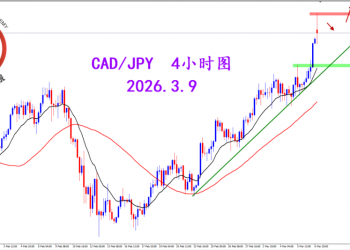

2026.3.9 图文交易计划:加日突破压制 多头300 人气#黄金外汇论坛

2026.3.9 图文交易计划:加日突破压制 多头300 人气#黄金外汇论坛 网纸「TL282.cc」腾龙公司游戏会员账号注册466 人气#美股论坛

网纸「TL282.cc」腾龙公司游戏会员账号注册466 人气#美股论坛 网纸「TL282.cc」腾龙公司注册游戏会员账号406 人气#美股论坛

网纸「TL282.cc」腾龙公司注册游戏会员账号406 人气#美股论坛 网纸「TL282.cc」腾龙怎么注册账号会员59 人气#游枷利叶 专栏

网纸「TL282.cc」腾龙怎么注册账号会员59 人气#游枷利叶 专栏