European Forex Trading Preview by Korman Tam

At 2:00 AM

Germany December WPI m/m (exp n/f, prev -0.1%)

Germany December WPI y/y (exp n/f, prev 1.5%)

At 2:45 AM

France November Trade Balance (exp 0.5 bln euros, prev 0.33 bln euros)

France December HICP preliminary m/m (exp 0.1%, prev 0.1%)

France December HICP preliminary y/y (exp 2.35%, prev 2.5%)

At 2:50 AM

France November industrial production m/m (exp 0.1%, prev 1.3%)

France November industrial production y/y (exp 1.1%, prev 0.9%)

At 4:30 AM

UK November industrial production m/m (exp 0.3%, prev 1.0%)

UK November industrial production y/y (exp 1.9%, prev 2.4%)

The dollar gave back earlier gains against the European majors, retreating

off its session high against the euro of 1.2720 to now sit at 1.2760.

Meanwhile, shortly after the New York session close, US Treasury spokesman

Robert Nichols reiterated that there had been no change to the strong

dollar policy. He also stressed that the Bush administration does

not comment on market movements.

Euro recovers from early sell-off

The single currency recovered from its sell-off in early Tokyo trading,

which had sent it to 1.2720 against the greenback. In yesterday's session,

the euro plummeted following comments from ECB President Trichet,

in which he expressed concern over the currency's strength.

The euro has since clawed its way back and stands at 1.2760.

Resistance begins at 1.28, backed by 1.2825 and 1.2880. Subsequent ceilings

are seen at 1.29, followed by 1.2930 and 1.2960. Meanwhile, losses

will find floors at 1.2720, backed by 1.27 and 1.2660. A breach below will

encounter floors at 1.2620 and 1.26.

EURJPY recouped losses back toward the 136-mark. Additional gains will

target 136.30, followed by 136.65 and 137. Subsequent ceilings are seen

at 137.20, followed by 137.80 and 138. Support begins at 135.50,

backed by 135 and 134.80. A move lower will target 134.25 and 134.

Cable

Cable jumped higher in early Tuesday trading, rising to 1.8470.

Further gains will face resistance at 1.85, followed by 1.8525 and 1.8550.

Additional ceilings will emerge at 1.8580 and 1.86. Support is seen

at 1.8450, backed by 1.84 and 1.8360. Subsequent floors are seen at 1.8320,

backed by 1.83 and 1.8270.

USDJPY remains confined in range

Japanese government officials reiterated their displeasure with currency

levels. The MoF's vice finance minister of international affairs,

Zembei Mizoguchi said that volatility and overshooting in the forex markets

were inappropriate and stressed that the government would take appropriate

action if necessary. Meanwhile, FinMin Sadakazu Tanigaki echoed a similar

message saying that recent forex moves were rapid given US economic

fundamentals. Lastly, he said that Japan would take steps against

speculative forex moves.

USDJPY hovers near 106.50 heading into the European session.

Interim resistance starts at 107, backed by 107.40 and 108. A breach above

will target 108.25 and 108.50. Losses will encounter support at 106.40,

backed by 106 and 105.75. Subsequent floors are eyed at 105.50, backed

by 105.30 and 105.

USDCHF

The pair failed to break above the 1.23-handle, and has since drifted

to 1.2260. Support is seen at 1.22 and 1.2130. A breach below will

target 1.2050 and 1.20. Gains will target resistance at 1.23, followed

by 1.2340 and 1.24. Subsequent ceilings will emerge at 1.2460, followed

by 1.25 and 1.2560.

AUDUSD

Interim resistance is seen at 0.78 and 0.7820. A breach above will target

0.7850, backed by 0.7880 and 0.79. Losses will target support at 0.7720,

followed by 0.77 and 0.7675. Subsequent floors will emerge at 0.7625,

backed by 0.76 and 0.7580. |

2025.12.16 图文交易计划:布油开放下行 关2422 人气#黄金外汇论坛

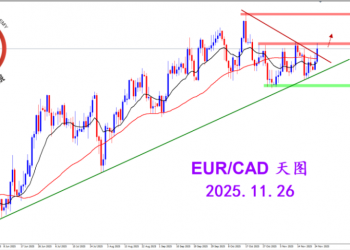

2025.12.16 图文交易计划:布油开放下行 关2422 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3144 人气#黄金外汇论坛

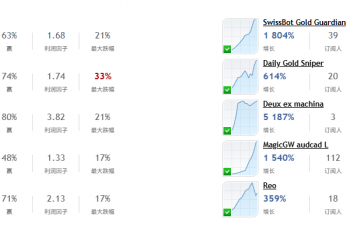

2025.11.26 图文交易计划:欧加试探拉升 关3144 人气#黄金外汇论坛 MQL5全球十大量化排行榜3190 人气#黄金外汇论坛

MQL5全球十大量化排行榜3190 人气#黄金外汇论坛 【认知】5993 人气#黄金外汇论坛

【认知】5993 人气#黄金外汇论坛