The Canadian dollar is down modestly from Thursday's close after volatile trading that took it to a 30-year high in morning dealings and then dashed it sharply lower after softer-than-expected Canadian GDP data for April.

Canadian bonds are sharply higher and are outperforming U.S. Treasurys after the news that gross domestic product was flat in April from the previous month.

The Investment Industry Association of Canada is recommending trading in the domestic bond market close at 1:00 p.m. EDT (1700 GMT) in advance of the Canada Day holiday Monday.

The U.S. dollar was trading at C$1.0620at 9:37 a.m. EDT (1337 GMT), from C$1.0548 at 8:00 a.m. EDT (1200 GMT), and from C$1.0597 late Thursday.

The U.S. dollar dropped to a low at C$1.0475, its lowest level since May 1977, according to EBS, in action that talk in the market linked to merger-and-acquisition flows and options-related activity, as a well as stronger oil prices.

"I think overall we have oil, which is very much supporting the move, along with other commodities, backed up by a broadly waker U.S. dollar, and lots of rumors about M&A activity going through," said Camilla Sutton, currency strategist at Scotia Capital.

The U.S. dollar managed to rebound from its low and had already recovered to the C$1.0558 area when Statistics Canada reported that GDP did not grow in April.

It said that Canada's economy was essentially unchanged in April, held back by significant declines in wholesale trade, oil and gas exploration and motor vehicle manufacturing.

GDP was C$1.11 trillion (US$1.05 billion), following its relatively strong performance the previous two months. The market had expected an increase of about 0.2%.

The U.S. dollar scurried higher after the release, reaching a high at C$1.0625 before retreating slightly.

"I think we saw it starting a little bit before then, but certainly the weaker-than-expected GDP data from Canada aggravated the move higher in dollar/Canada," Sutton said.

Several analysts said stagnant GDP growth in April won't stop the Bank of Canada from raising interest rates at its next policy announcement date on July 10 as expected.

"Despite the disappointing numbers for April, growth over the first half of the year is still expected to exhibit above-potential growth," said a report from RBC Financial Group.

"Given the Bank of Canada's expressed concern about the upside risk to inflation, the overnight rate is still expected to rise 25 basis points next month," it said.

The U.S. dollar is still very weak in terms of the other currencies, so it will probably see limited upside against its Canadian counterpart, said Scotia's Sutton.

"I think we've probably seen a lot of the move today, and we'll probably start to settle out pretty close to where we are, maybe just a little bit lower," Sutton said.

"I think, overall, we've seen a tremendous amount of movement this morning," she said.

Technically, the dramatic move lower earlier Friday foreshadows further downside for the U.S. dollar, as it broke out of the bull channel it has been in for the last few weeks, as well as shifting below the previous low for the year at C$1.0550, she said.

The move opens up the possibility of the U.S. dollar dropping to the C$1.0400 area.

"This kind of move really shows that the bears are in control," Sutton said.

At 10:30 a.m., the Bank of Canada will release its quarterly business outlook survey.

Canadian bonds are sharply higher across the yield curve after the soft monthly GDP report for April.

The benchmark 10-year bond is yielding 4.58%, from 4.63% Thursday. Its negative spread against the equivalent U.S. Treasury bond is 50 basis points, from 48 Thursday.

The two-year bond is yielding 4.60%, from 4.66%.

These are the exchange rates at 9:37 a.m. EDT (1337 GMT), 8:00 a.m. EDT (1200 GMT), and late Thursday.

USD/CAD 1.0620 1.0548 1.0597

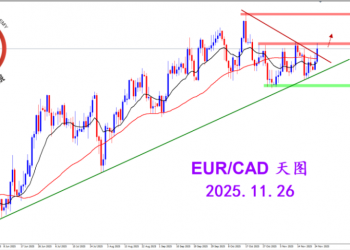

EUR/CAD 1.4354 1.4239 1.4235

CAD/JPY 116.24 117.03 116.39

-Don Curren; Dow Jones Newswires;416-306-2020; don.curren@dowjones.com |

2025.12.16 图文交易计划:布油开放下行 关2384 人气#黄金外汇论坛

2025.12.16 图文交易计划:布油开放下行 关2384 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3117 人气#黄金外汇论坛

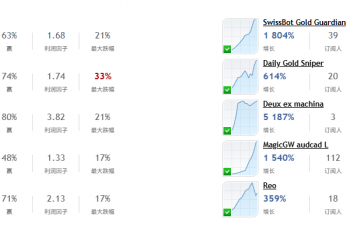

2025.11.26 图文交易计划:欧加试探拉升 关3117 人气#黄金外汇论坛 MQL5全球十大量化排行榜3163 人气#黄金外汇论坛

MQL5全球十大量化排行榜3163 人气#黄金外汇论坛 【认知】5973 人气#黄金外汇论坛

【认知】5973 人气#黄金外汇论坛