The Results Snapshot shows the important results of diamond tops and bottoms.

In appearance, the only difference between the two diamond patterns is

the price trend leading to the formation. For diamond tops, the prior price

trend is upward, whereas diamond bottoms have price trends that lead down to

the formation.

The performance of the two types is similar. Both act as reversals of die

prevailing price trend with a volume trend that diminishes over time. Volume

on the day of the breakout is also high.

The failure rate for tops, at 25%, is more than double the rate for bottoms.

I consider failure rates above 20% to be alarming, so you might consider

tops unreliable.

The average decline (21%) and rise (35%) is about what you would expect

for reversals, with bottoms a bit shy of die usual 40% rise for bullish formations.

However, the most likely decline for tops is near the average, suggesting

that there are few large declines to distort the average. Diamond bottoms, with

a likely rise of just 15%, are well away from the 35% average gain. This suggests

there are a high number of formations with smaller gains that balance a

few larger ones.

这是从Encyclopedia of Chart Patterns上粘贴过来的,只可惜认识的词比不认识的多,希望有高人能翻过来。。 |

2026.2. 6 图文交易计划:纽美快速回落 短209 人气#黄金外汇论坛

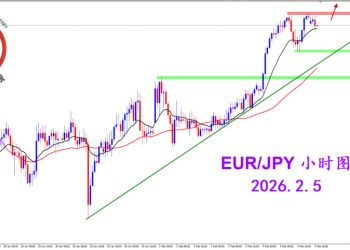

2026.2. 6 图文交易计划:纽美快速回落 短209 人气#黄金外汇论坛 2026.2.5 图文交易计划:欧日短线强势 谨慎450 人气#黄金外汇论坛

2026.2.5 图文交易计划:欧日短线强势 谨慎450 人气#黄金外汇论坛 2026.2.4 图文交易计划:关键位置遇阻 美指451 人气#黄金外汇论坛

2026.2.4 图文交易计划:关键位置遇阻 美指451 人气#黄金外汇论坛 2026.2.3 图文交易计划:欧镑格局破位 空头668 人气#黄金外汇论坛

2026.2.3 图文交易计划:欧镑格局破位 空头668 人气#黄金外汇论坛